corporate tax increase uk

Profits are the amount of. In order to support the recovery the increase will not take effect until 2023.

Is Labour Party S Plan To Raise Corporation Tax A Good Idea Financial Times

Once the corporation tax rate increase takes effect in April 2023 the applicable corporation tax rates will be 19 and 25.

. From 1 April 2023 an increase from 19 to 25 in the main rate of corporation tax and the introduction of a 19 small profits rate of corporation tax for companies whose profits. Corporation tax is paid to the government by UK companies and foreign companies with UK offices. Businesses with profits of 50000 or less around 70 of actively trading companies will.

The Growth Plan set out by the then Chancellor Kwasi Kwarteng on 23 September 2022 included. Rishi Sunak had scheduled corporation. In addition the UK government will launch several.

An update on what has changed. Companies with profits between 50000 and 250000 will pay tax at the main rate reduced by a marginal relief providing a gradual increase in the effective Corporation Tax rate. The UKs new Chancellor of the Exchequer said Monday that he will undo almost all of the tax cuts that the government announced less than a month ago.

In line with the 6 percent CT rate increase the rate of Diverted. Prime Minister Liz Truss has announced that corporation tax will rise to 25 per cent this spring abandoning one of her key tax cut policies. The normal rate of corporation tax is 19 for the financial year beginning 1 April 2021 and will be maintained at this rate for the financial year.

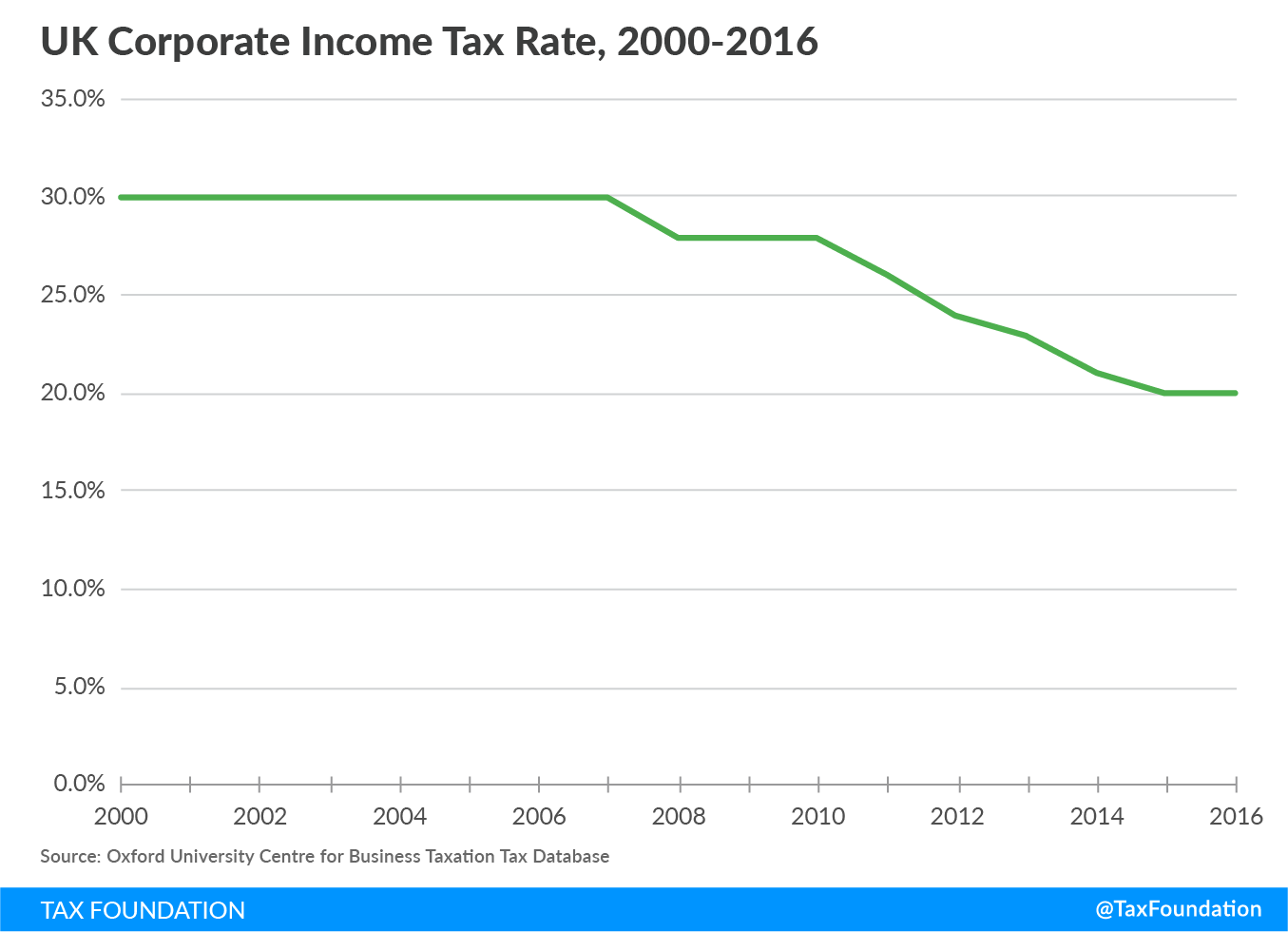

General corporation tax rates. The 2021 UK budget introduces a two-year super-deduction of 130 percent for plant and equipment and a delayed corporate tax rate increase from 19 percent to 25 percent. The reversal of the policy is one of the.

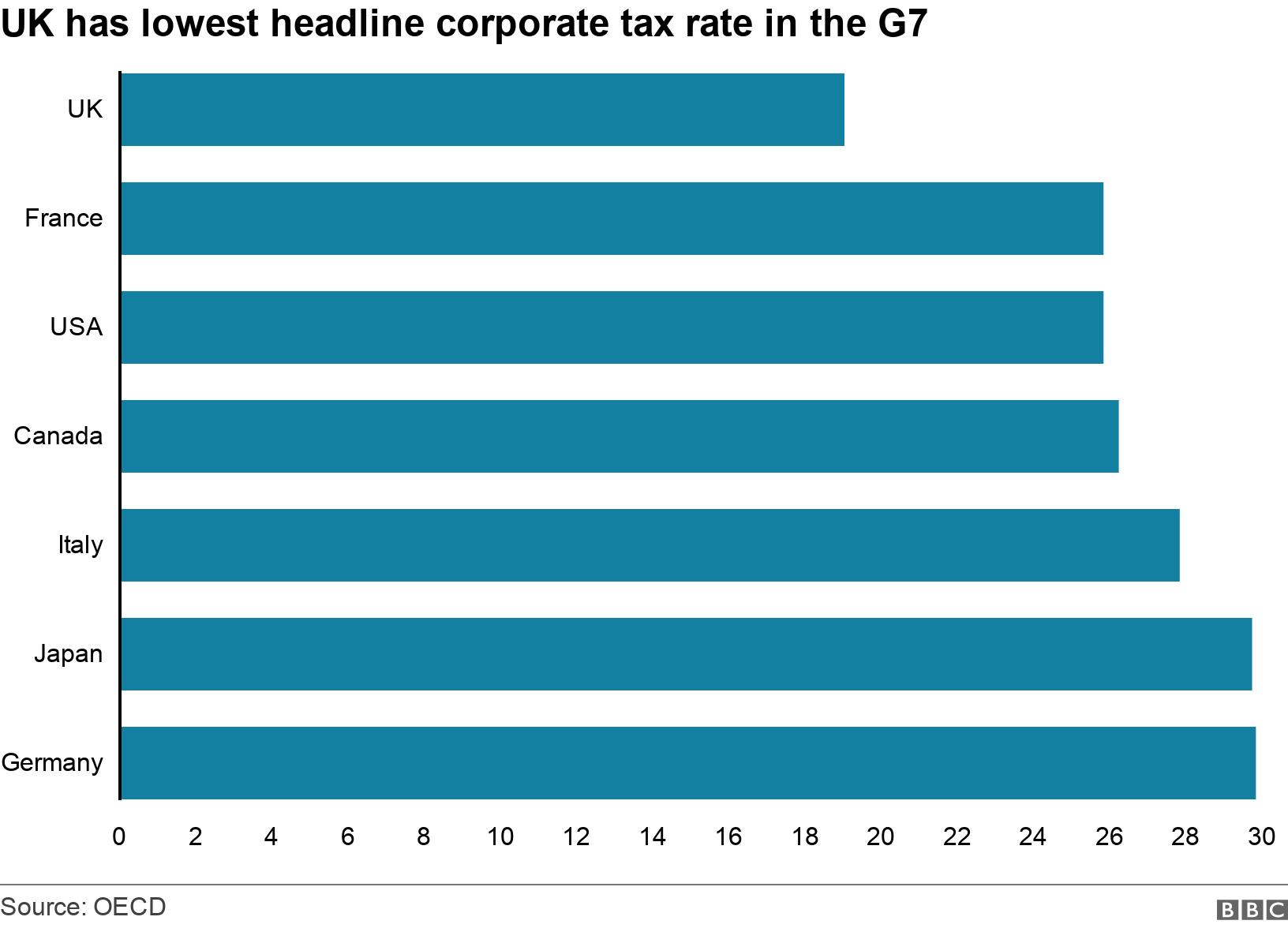

The rate of corporation tax paid on company profits is to rise to 25 from 19 starting in 2023. The legislation that provided for this increase also sets out. This change was introduced by Finance Act 2021 and may have some.

Embattled British Prime Minister Liz Truss on Friday announced she would no longer scrap a planned increase in corporate tax a huge. UK Premier Truss reverses plan to scrap corporate tax increase Corporate tax increase will now go ahead after market turmoil triggered by plans for unfunded tax cuts Karim. They are currently charged 19 of their profits.

Corporation Tax rise cancellation factsheet. Wednesday the United Kingdom will publish its 2021 budget after the fall budget was delayed due to the pandemic. Under the previous governments plans the rate of Corporation Tax was to increase from 19 to 25 from April 2023 for firms.

Businesses with profits of 50000 or below would. The corporation tax will increase to 25 from 1 April 2023 affecting companies with profits of 250000 and over. The UKs main rate of corporation tax will increase from 19 per cent to 25 per cent with effect from 1 April 2023.

Chancellor Rishi Sunak said it was fair and necessary for business to. AA Friday 2318 14 October 2022. The planned increase in UK corporation tax from 19 to 25 from April 2023 has been cancelled the chancellor has confirmed.

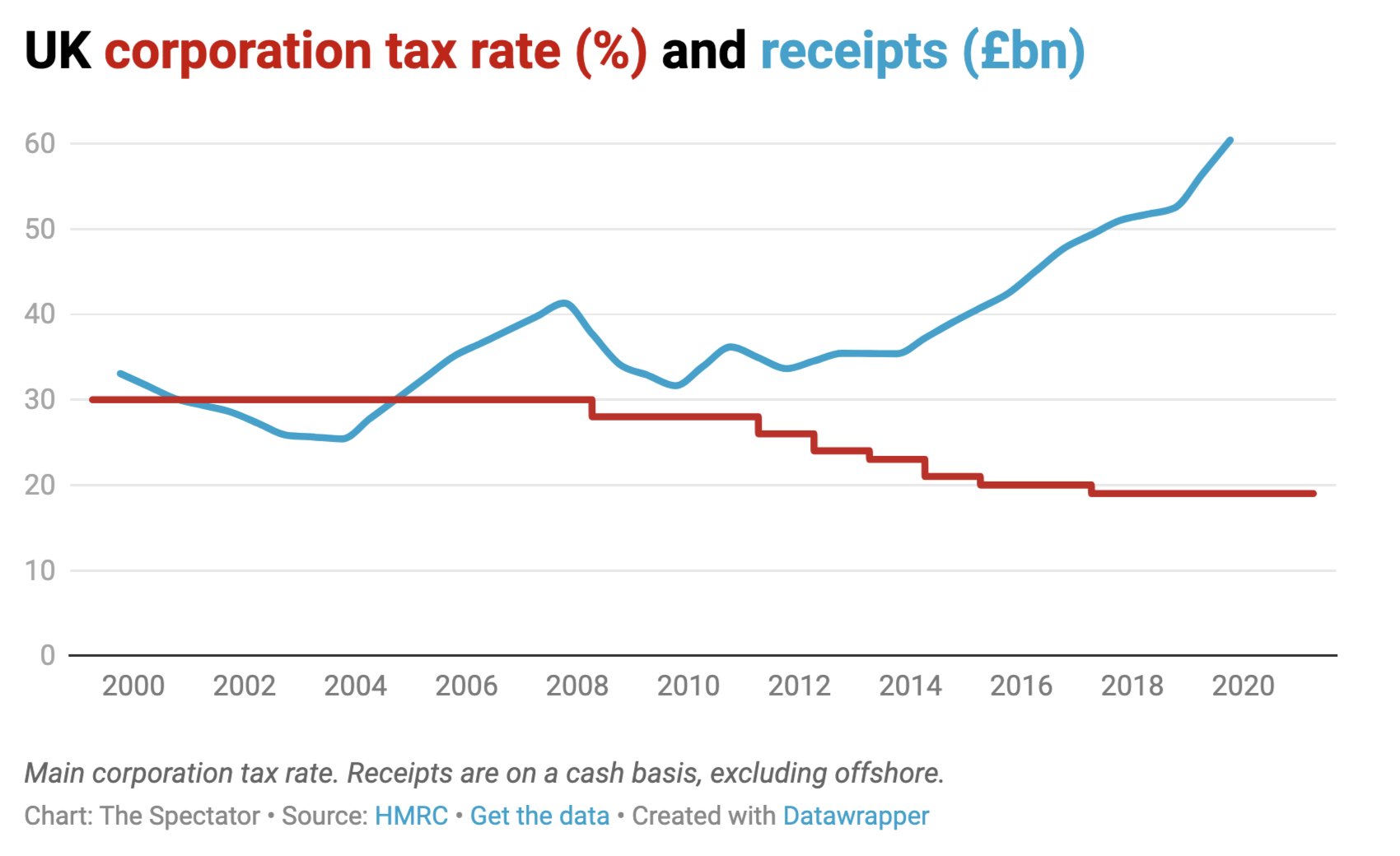

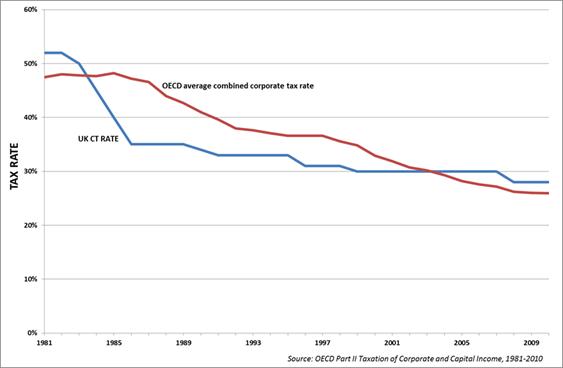

Corporate Tax Rate in the United Kingdom averaged 3040 percent from 1981 until 2022 reaching an all time high of 52. The increase is projected to bring in additional revenues of 119 billion in 2023-24 rising to 172 billion in 2025-26. Britains corporation tax will rise to 25 from April next year Prime Minister Liz Truss said on Friday just hours after sacking her finance minister Kwasi Kwarteng U-turning on.

The Corporate Tax Rate in the United Kingdom stands at 19 percent.

Fraser Nelson On Twitter Fascinating Graph From Kate Andrews Showing How Uk Corporation Tax Revenues Rose When The Corporation Tax Rate Dropped Https T Co Rurapik4yc Https T Co W5sswc4scx Twitter

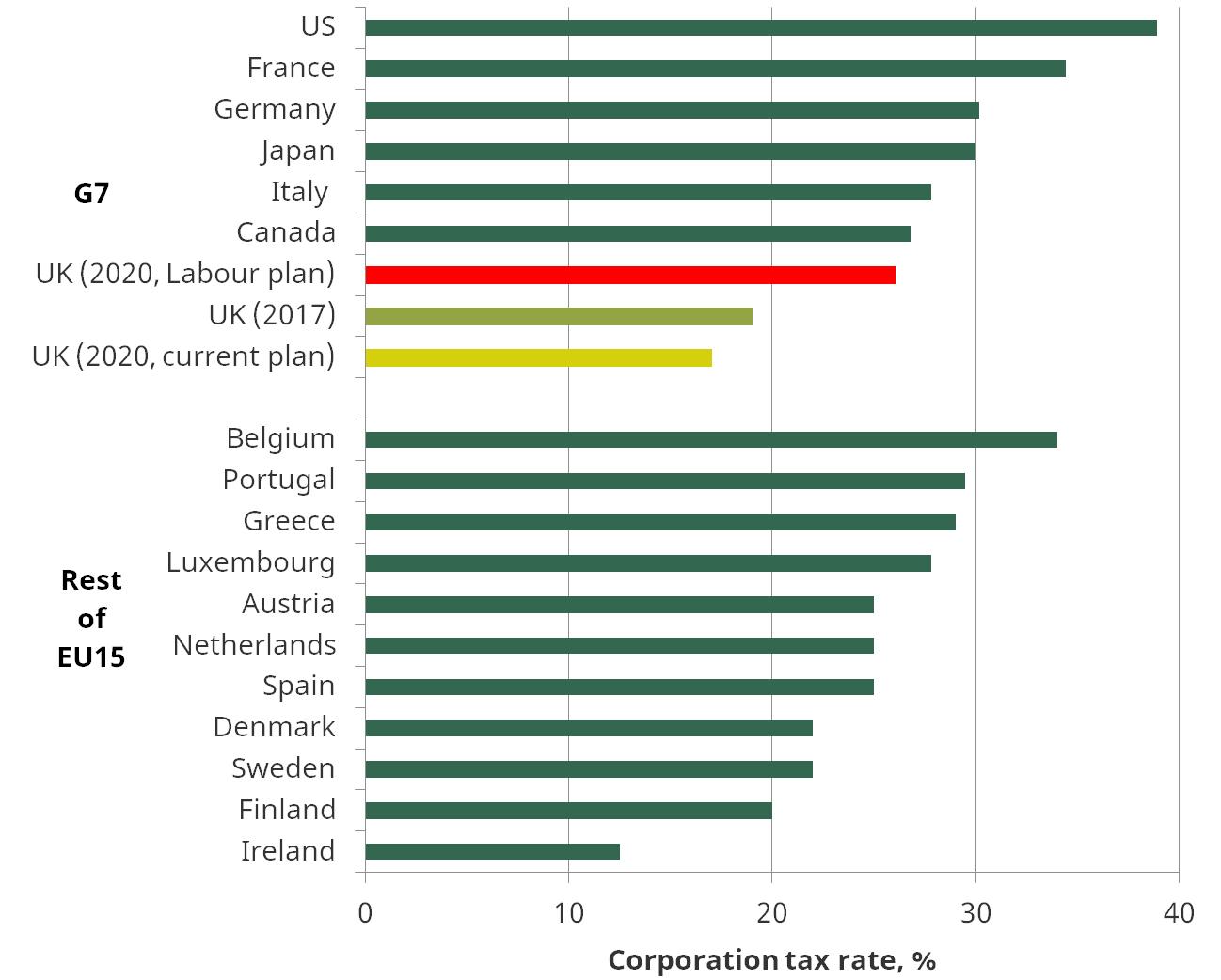

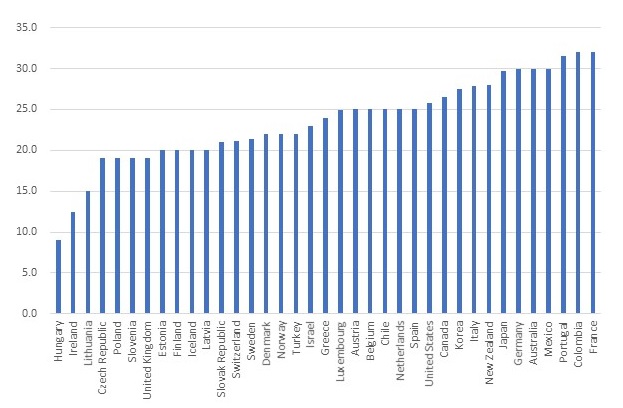

Corporate Tax Rates Around The World Tax Foundation

/cdn.vox-cdn.com/uploads/chorus_asset/file/9498929/Corporate_tax_rate_graphic.PNG)

Trump S Economists Say A Corporate Tax Cut Will Raise Wages By 4 000 It Doesn T Add Up Vox

Uk Corporation Tax Rate 2022 23 Freeagent

Us Ceos Think Biden S Corporate Tax Rate Hike Will Have Negative Impact Survey Us Taxation The Guardian

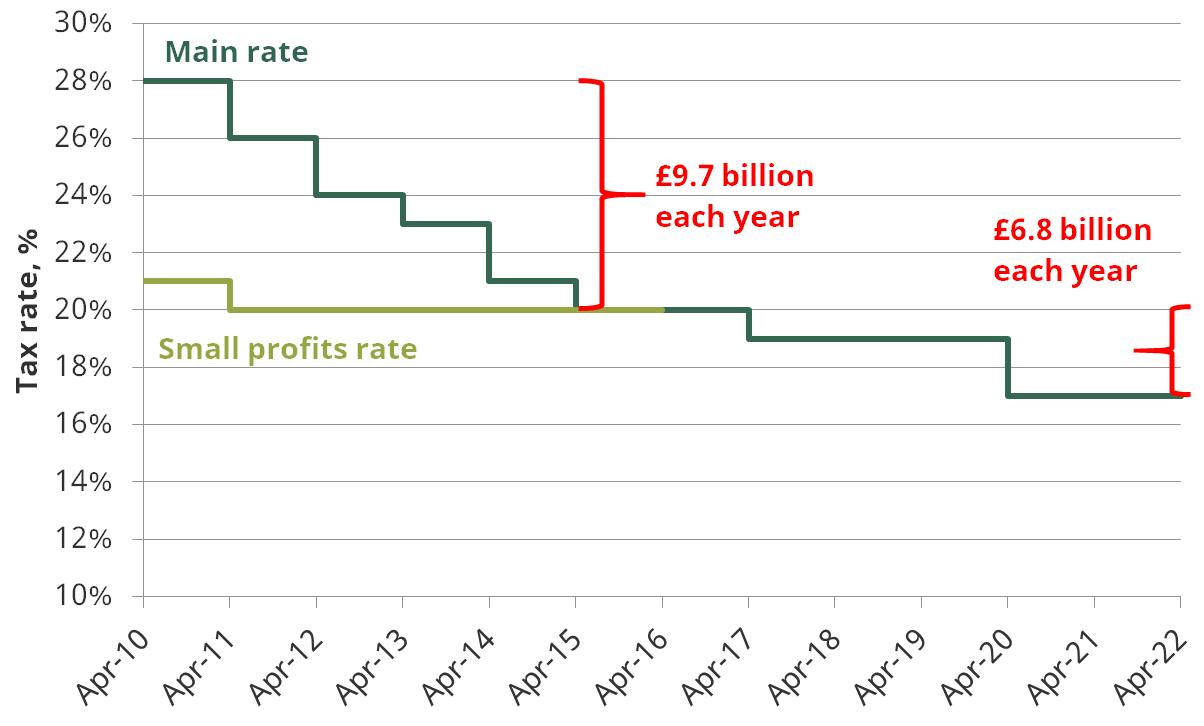

What S Been Happening To Corporation Tax Election 2017 Ifs

House Of Commons Treasury Written Evidence

136 Countries Agree To 15 Minimum Corporate Tax Rate Engoo Daily News

Labour S Reversal Of Corporate Tax Cuts Would Raise Substantial Sums But Comes With Important Trade Offs Election 2017 Ifs

What Is Corporation Tax And Who Has To Pay It Bbc News

United Kingdom Corporation Tax Wikipedia

Uk Dropping Corporate Rate To 20 Percent Half The Us Rate Tax Foundation

A Cut In The Corporation Tax May Not Be Popular But It Would Be Beneficial To Everyone British Politics And Policy At Lse

Sunak Gives Himself Scope To Increase U K Corporation Tax Bloomberg

What We Can Learn From The Uk S Corporate Tax Cuts Tax Foundation

Uk Urged To Cancel Corporate Tax Increase To Boost Investment Bloomberg

Corporation Tax Will Increase To 25 From 2023

Be Cautious About Raising The Corporation Tax Rate Oxford University Centre For Business Taxation

Cancelling Further Cut To Corporation Tax Rate Leaves Revenue The Same As Before The 2008 Crisis Institute For Fiscal Studies Ifs